Digital and entertainment retail association ERA has issued its preliminary numbers for the past year, and they make encouraging reading for the physical music sector following years of overall decline (although vinyl sales alone have soared for the past decade and more).

Overall, UK spending on music streaming subscriptions, vinyl, CDs, downloads and cassettes grew by 9.6% based on value in 2023, nearly twice as fast as 2022 (which saw an increase of 5%). As part of that sales performance, there was a rare increase in CD sales last year – the first in two decades.

The £2.22 billion total for 2023 was the highest since 2001, the historic peak of the CD era, and just 0.08% short of that record. It was more than double the level of 2013 when music sales were being hammered by internet piracy.

Two years ago, ERA reported a rare increase in overall physical sales (vinyl, CD and cassettes combined) during 2021, although that wasn’t repeated the following year as vinyl sales growth softened a little in 2022 (but still outsold CD for the first time in terms of revenue).

But 2023 was a blockbuster year for physical music sales, delivering growth across the board. A strong release schedule included albums by Taylor Swift, whose 1989 (Taylor’s Version) was the biggest seller on vinyl last year, as well as Take That, the Rolling Stones, Lewis Capaldi, Lana Del Rey, Blur, Olivia Rodrigo, Pink, Kylie Minogue, Foo Fighters, Metallica and Noel Gallagher’s High Flying Birds.

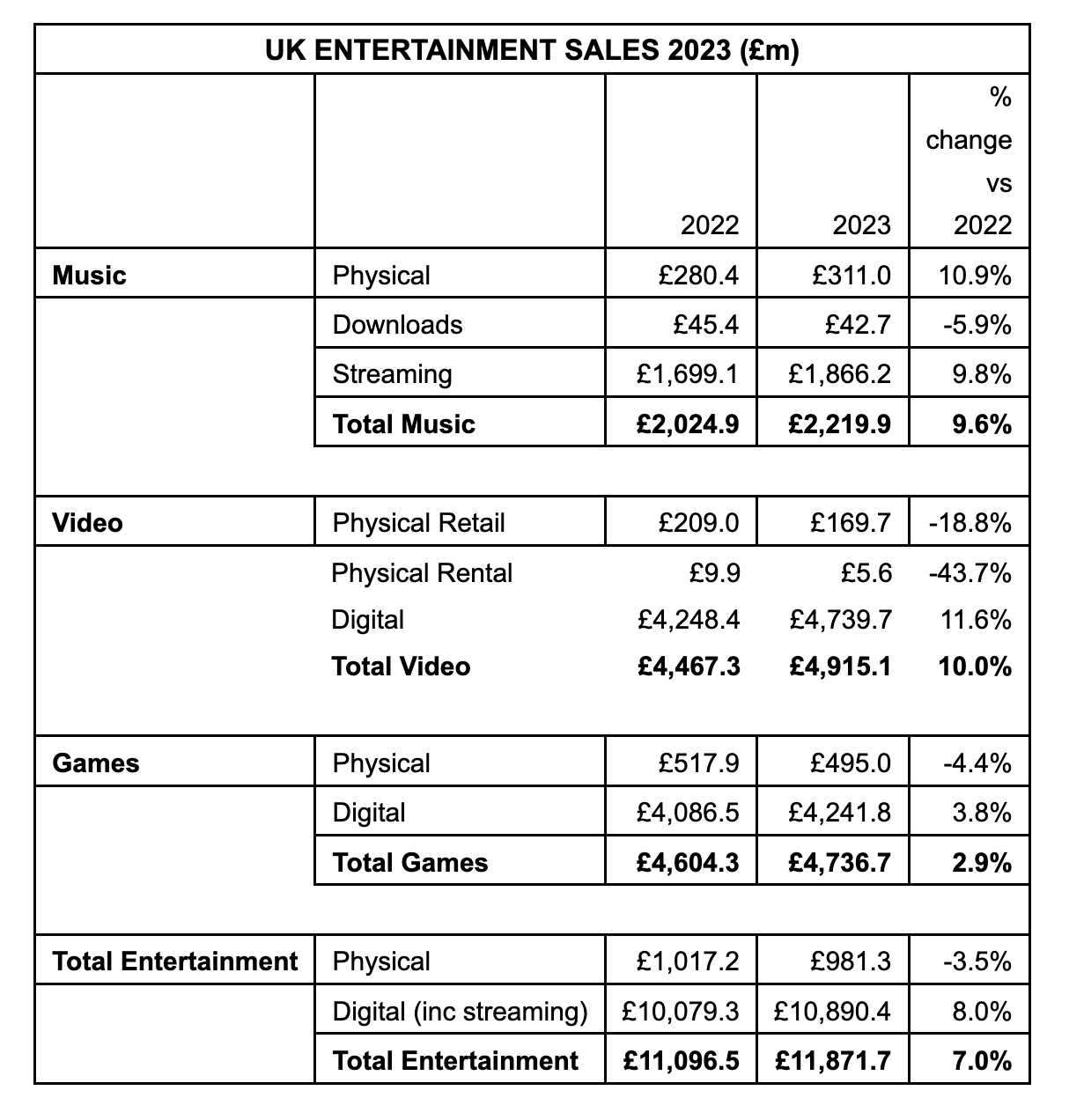

ERA said that overall physical sales increased by 10.9% year-on-year to £311 million, a significant improvement on 2022’s 4% decline. It was also ahead of the 7.3% growth for physical sales in 2021, which was then the first such increase since 2001.

Vinyl album sales grew by 17.8% year-on-year in 2023 to reach £177.3m, while CD recorded its first rise in sales value for 20 years – up 2% to reach £126.2m. Take That’s This Life was the biggest seller in the format last year.

Vinyl pulled ahead of CD in 2022 in value terms (though not in units), and the older format extended its lead last year.

“The strength of physical sales was all the more remarkable given significant distribution problems which affected much of the industry in late summer 2023,” noted ERA in its end-of-year results for retail. The numbers are based on data from the Official Charts Company and the BPI.

Of course, the main driver of growth in 2023 came from streaming services such as Spotify, YouTube, Amazon and Apple, which grew subscription streaming revenues by 9.8% to £1.866 billion, an all-time-high.

The biggest album of the year across all formats was The Highlights by The Weeknd, while Miley Cyrus had the biggest single with Flowers.

The CD sales increase for 2023 tallies with results from HMV, who have just returned to London’s Oxford Street with a flagship store. The chain’s owner Doug Putman recently told Music Week that it had increased CD sales in terms of both units and revenue.

With revenues just a fraction away from music’s all-time-high, this is a red letter day for the music industry

Kim Bayley

ERA CEO Kim Bayley said: “With revenues just a fraction away from music’s all-time-high, this is a red letter day for the music industry and is a testament not just to the creativity of artists, but to the entrepreneurial drive of digital services and retailers. A world without streaming now seems unthinkable. Meanwhile the tenacity of physical retailers has driven not just the vinyl revival, but a surprise increase in the value of CD sales. Given all we’ve been through, it really doesn’t get much better than this.”

ERA’s figures are based on value, so price increases have helped boost the physical sales result. Nevertheless, other sectors did not register such growth from an inflationary boost: video physical retails sales were down 18.8% by value and physical games were down 4.4%.

According to the BPI’s unit-based sales figures released last week, sales for CD were down in terms of units in 2023. However, the decline in CD sales slowed to 6.9% – the lowest annual rate of decline since 2015 – to register 10.8 million units.

According to those BPI stats, vinyl LP sales increased for the 16th consecutive year in 2023, growing at their fastest rate this decade with an 11.8% rise to 6.1 million units. This took them to their highest level since 1990. Overall, physical music narrowly missed out on its first year-on-year increase in units since 2004 – the peak year for CD sales in the UK – with sales dipping 1.1% to 17.1m units.

Digital and entertainment retail in 2023

According to ERA’s report today, overall music sales growth of 9.6% across digital and physical was in line with that for the video entertainment market (10%) and ahead of the 2.9% increase for the games sector.

The combined value of the UK music, video and games markets increased for the 11th successive year in 2023, rising 7% to another all-time record of £11.9bn.

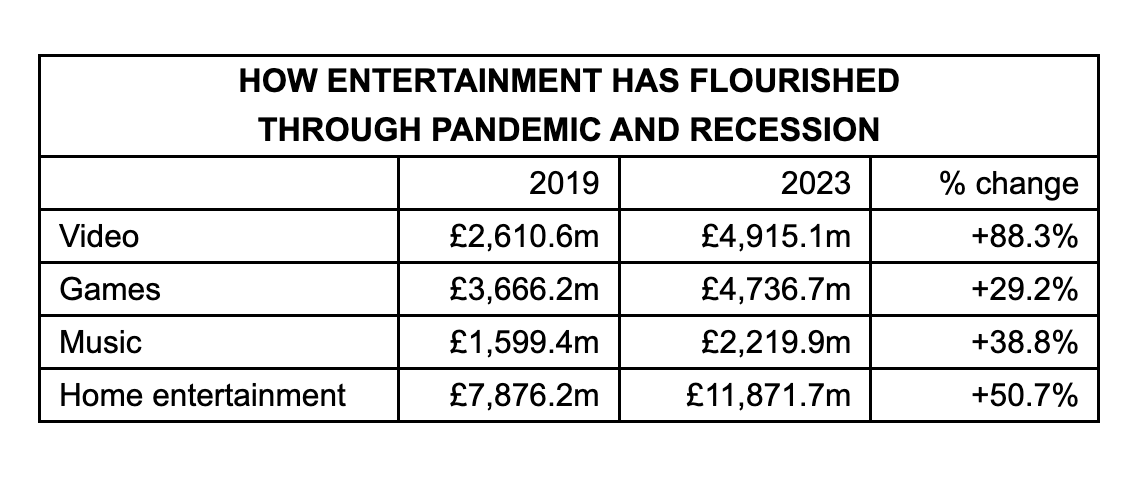

It means that the entertainment market has grown by just over 50% since the last pre-pandemic year of 2019, led by video (up 88.3%), followed by music (up 38.8%) and games (up 29.2%).

ERA chairman Ben Drury said: “The entertainment business is defying gravity, delivering eleven straight years of growth regardless of wider economic conditions. Due credit should go to the amazing creative talent behind the movies, music and games we all love, but we should also recognise the huge contribution of the digital services and retailers who have reinvented the entertainment experience for consumers over the past 15 years. The overwhelming majority of the money raised by digital services and retailers goes direct to the content owners, and their success is directly benefiting creators.”

Click here to read our analysis of the recorded music market for 2023.

PHOTO: HMV Oxford Street (Peter Nicholls/Getty Images)