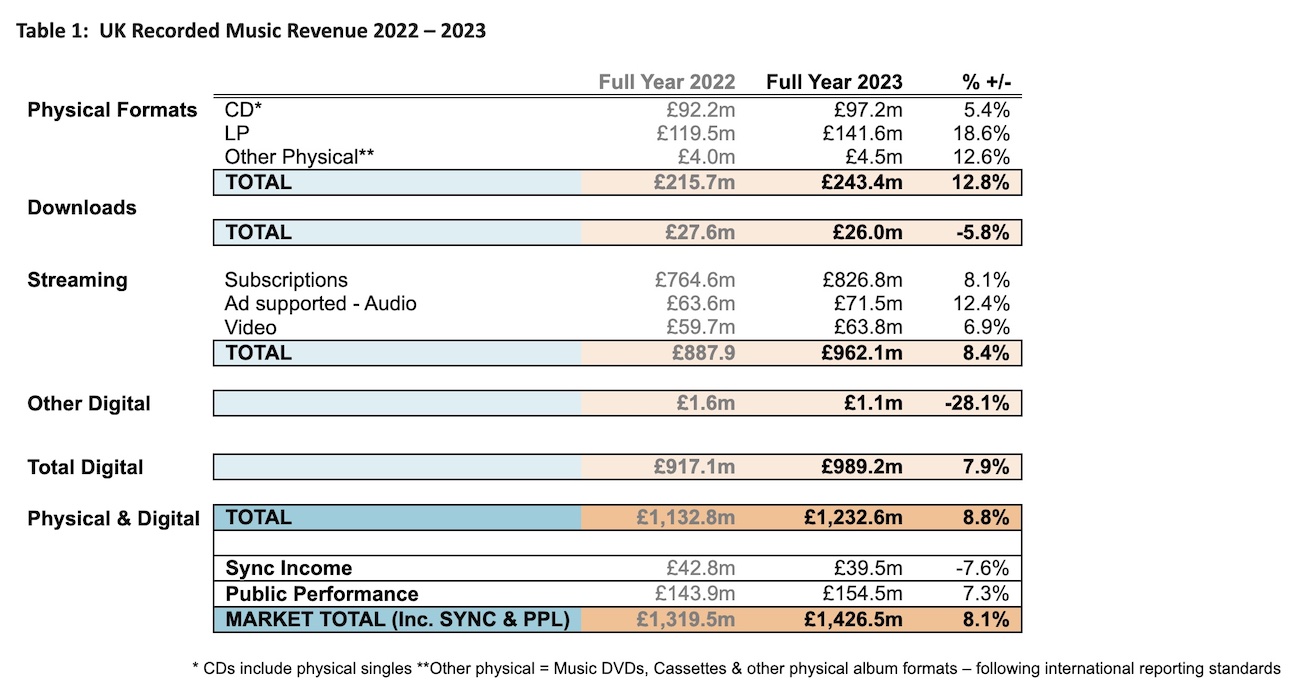

UK recorded music revenue increased by 8.1% year-on-year to £1.43 billion in 2023, according to the BPI.

The figure, which includes revenue from synchronisation and public performance, marks the ninth consecutive year of growth. It is ahead of the 4.7% growth recorded in 2022.

The BPI said it has been fuelled by UK record labels investing hundreds of millions of pounds annually to support artists’ careers through A&R, marketing and promotion.

As the market continues to grow, more artists are hitting at least 10 million audio streams of their music in the UK each year. In 2023 2,245 artists surpassed the total of 10m audio streams in the UK, 17% more than two years earlier, with many accumulating tens of millions of streams globally too.

The total trade revenue figure for last year was the highest nominal annual amount achieved to date for recorded music in the UK.

However, once adjusted for inflation using CPI (consumer price index), trade revenue was £478m below where the industry should have been in real terms. That recalculated figure is based on the trajectory since 2006, the first year when public performance and sync were included in the annual total. Using the RPI (retail price index) measurement of inflation, trade revenue was actually £771m lower than it would have been based on a real terms increase.

ERA recently reported record retail revenue for UK recorded music, again with the caveat that inflation is not factored into the calculation.

Streaming outperformed the overall market, up 8.4% to £962.1m, representing 67.4% of recorded music revenue (67.3% in 2022). Streaming is now by far the industry’s main revenue generator, having in 2013 accounted for only 8.6%.

Revenue from physical formats grew by 12.8% in 2023, having fallen by 10.5% the previous year. This was led by a double-digit percentage rise in vinyl LP sales, as well as CD revenue recovering.

While inflation was clearly a factor, there are signs of CD having turned a corner. High-value box sets could also be contributing to value growth for the format. ERA recently reported the first value increase in CD sales in 20 years.

Vinyl revenue was up by 18.6% year-on-year to £141.6m, while CD posted a 5.4% increase to £97.2m, following a 23.7% fall in 2022. A year after generating more trade revenue than CD for the first time since 1987, vinyl moved further ahead when it made up 58.2% of all physical music revenue, compared to 55.4% in 2022.

It’s vital the right conditions remain in place to give British music every opportunity to thrive

Dr Jo Twist

Music Week’s Q1 sales snapshot recently showed vinyl unit sales increasing 14.5% year-on-year. According to the latest Official Charts Company data, the current self-titled No.1 album by Liam Gallagher & John Squire has the biggest vinyl sales for the year to date (19,242). It also scored the biggest weekly total of the year so far on the format (17,654).

Chart-topping albums so far this year by Liam Gallagher & John Squire, The Last Dinner Party, Idles, Rod Stewart & Jools Holland, James Arthur, Green Day, D-Block Europe, Shed Seven and Lewis Capaldi have all been powered by majority physical sales.

Only Noah Kahan’s Stick Season has reached No.1 in 2023 with streams accounting for the majority of chart sales. The album is the first of the year to pass 100,000 sales (100,508) and currently leads the way in the year-to-date sales rankings across all formats, Music Week can reveal.

With sales of 49,733, The Last Dinner Party’s Prelude To Ecstasy is the biggest 2024 album release of the year so far (up to chart week 10), and the 10th biggest overall.

Dr Jo Twist OBE, BPI chief executive officer, said: “Led by streaming, this ninth consecutive annual rise in recorded music revenues highlights how a balanced and prosperous market enabled by significant label investment can help even more artists to succeed. It would be all too easy to take this growth for granted, but at a time when British music faces unprecedented competition from around the world and challenges at home, it’s vital the right conditions remain in place here to give British music every opportunity to thrive.”

YolanDa Brown OBE DL, artist, music education campaigner and BPI chair, said: “It's fantastic that the UK recorded music market hit a new high last year, which is testament to all the incredible music that diverse artists are creating, including across new genres, with the support of their record labels. As someone who has such fond memories going into record shops as a child to buy CDs, I am particularly pleased that the popularity of this wonderful format is showing signs of a revival, something that we’ve been seeing with vinyl for well over a decade now., as the ONS has now picked up on.”

Streaming revenue

Paid subscriptions to services such as Amazon, Apple, Deezer, Spotify and YouTube made up nearly 86% of the £962.1m of revenue generated by music streaming in the UK in 2023. Paid subscription revenue rose by 8.1%, more than twice the growth rate achieved in 2022.

Revenue from ad-supported audio services grew at a faster rate last year, up 12.4% to £71.5m, although it only contributes 8% of total streaming revenue. Digital download revenue dropped for a 10th consecutive year to £26m.

Flowers by Miley Cyrus was the most-streamed track of 2023 with 198.1m audio and video streams in the UK, followed by Sprinter by Dave & Central Cee (160.6m streams) and Escapism by Raye feat. 070 Shake (142.0m streams).

Vinyl revenue

The £141.6m of revenue generated by vinyl in 2023 was nearly 12 times the amount the format brought in back in 2013 when it contributed just over £12m to the market.

New releases were the main driving force last year behind the 18.6% rise in vinyl revenue. Seven of 2023’s 10 biggest sellers on the format had been released in the calendar year, including 1989 (Taylor’s Version) by Taylor Swift (the biggest vinyl seller of the year), Hackney Diamonds by the Rolling Stones and Did You Know There’s A Tunnel Under Ocean Blvd by Lana Del Rey.

That contrasts with the overall albums rankings for 2023 in which streaming powered consumption of catalogue, leaving just one 2023 album in the Top 10 (Swift’s reworking of 1989).

CD revenue turnaround

Although vinyl has re-established itself as the biggest physical format in terms of income, CD label trade revenue has now increased annually in two of the last three years. Last year it was up 5.4% to £97.2m.

Take That’s This Life was the biggest seller on the format in 2023.

From a much lower base, cassettes have seen a revival in recent years although unit sales actually decreased last year. Nevertheless, the format contributed to an increase in value of 12.6% to £4.5m for ‘Other physical music’ (ie not vinyl or CD, but including cassettes, music DVD and other formats). Olivia Rodrigo’s Guts was the biggest cassette of 2023.

The rising demand for vinyl and CD releases has been boosted by annual events such as Record Store Day and National Album Day, amid signs that a new generation of fans are embracing physical music.

ERA recently reported on an increase in the number of independent record shops. Meanwhile, labels are increasingly targeting superfans, which will also help to drive further growth in physical music income.

Public performance revenue

Public performance income, which is generated by the broadcast and public performance of recorded music, increased by 7.3% year-on-year, with £154.5m collected on behalf of record labels in 2023.

There is currently a government consultation on the public performance remuneration system that could impact US-owned labels in the UK

Income from synchronisation, when music is used in visual media such as film, TV, games and advertising, was £39.5m last year, a drop of 7.6% on the year before.