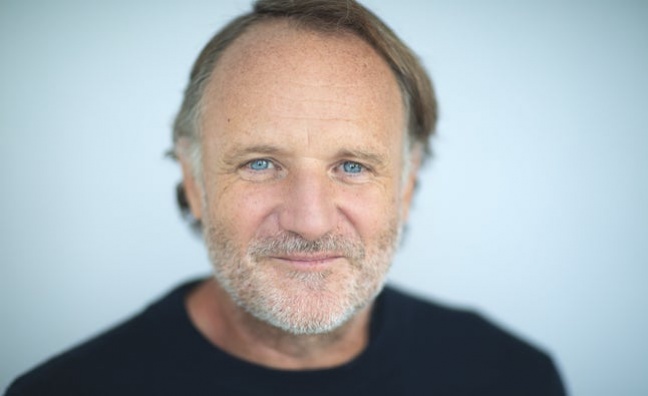

Denis Ladegaillerie, chairman and CEO of Believe, has formed a consortium with funds managed by TCV and EQT, to make an offer for all outstanding shares of the music company.

If successful, the move would take the French company private again under the consortium’s control. Believe went public in summer 2021 and is listed on compartment B of the regulated market of Euronext Paris.

Believe posted a strong performance in 2023, including organic growth of 14%. The company has around 2,000 staff in 50 countries. Its portfolio of brands covering services for the music industry includes Believe, TuneCore, Nuclear Blast, Naïve, Groove Attack, AllPoints, Ishtar and Byond.

The offer for all Believe outstanding shares (at €15 per share) follows agreed acquisitions from historical shareholders TCV Luxco BD, Ventech and XAnge. The consortium has agreed to acquire the stakes (at the offer price) of TCV Luxco BD, Ventech and XAnge, representing respectively 41.14%, 12.03% and 6.29% of Believe shares.

In addition, it is intended that Denis Ladegaillerie will contribute a portion of his company shares (representing 11.17% of the share capital) and sell the remaining portion (representing 1.29%) to the consortium.

That would bring the consortium’s ownership to 71.92% of the capital. It has also obtained undertakings from other shareholders to sell at the offer price, which represents a 21% premium on the closing share price prior to the announcement.

Denis Ladegaillerie, founder, chairman and CEO of Believe, said: “Since being a public company, Believe has systematically outperformed its objectives, delivering its IPO plan two years ahead of schedule. However, the strength of its operational performance has not been reflected in the share price evolution. Believe has a significant opportunity ahead to consolidate the independent music market and create the first global major independent, at the service of artists at all stages of their career. In achieving this ambition, I am glad to continue benefiting from the active support of TCV who has accompanied Believe since 2014 and to be partnering with Europe-based EQT who has a great track record in supporting high growth companies.”

Believe has a significant opportunity ahead to consolidate the independent music market and create the first global major independent

Denis Ladegaillerie

Nicolas Brugere, partner, EQT, said: “Believe’s track record in developing labels and artists worldwide is exceptional. With the music market growth and digitalisation, Believe has significant potential to continue thriving, through organic expansion and strategic acquisitions. We are excited to invest alongside TCV and Denis to back that next phase of development. We are fully aligned with Believe’s core values of fairness, respect and transparency and are committed to support their talented team for future success.”

John Doran, general partner, TCV, said: “Believe is strongly positioned as the partner of choice for independent artists and labels globally, as well as for artists and labels that have a digital-first mindset. We at TCV see Believe’s focus on local content, coupled with its full stack offering addressing all artist segments and focusing on digital artist development over the long term, as highly differentiated, making them a strategic partner for digital streaming platforms globally. We are excited to be partnering with EQT to back Denis and the Believe team, as they continue to scale their business and expand globally."

Following the completion of this process, the consortium will make a mandatory tender offer for the remaining Believe shares at the offer price, with a view to taking the company private.

The shareholder block acquisitions so far agreed and the offer for outstanding shares are subject to regulatory and board approval, following an independent study. The board has already welcomed the offer.

The tender offer is set to be filed with France’s Autorité des Marchés Financiers (AMF) in Q2.