Spotify’s earnings call today is probably the most important in its short history as a public company – but maybe not for the reasons you think.

After several months of solid growth since its April IPO, Spotify’s share price has been heading downwards in recent weeks, even touching a ‘record low’ at one point. It closed yesterday at $152.80 (£119.65), almost $50 (£39.15) below its high water mark back in the heady summer days of July, meaning billions have been wiped off its market cap. And the relatively high volume of trading suggests institutional investors are involved.

None of that is great news, but nor should it worry Daniel Ek unduly, assuming he means what he says. After all, Spotify had no market value at all just seven months ago, and the volatility for all tech stocks right now means the only All Time Low they should be concerned about is the pop-punk band with 2.9 million monthly listeners on their service. And, as for institutional investors, well, Spotify’s unusual direct listing approach was specifically designed to prevent Ek from dancing to the bankers’ tune.

Spotify’s stock remains highly rated by analysts and the fact that its IPO was not designed to raise cash means it should be less concerned about investor pressure than most NYSE freshmen. True, Spotify’s earnings calls to date have not necessarily inspired much confidence, but today’s update should be about holding their own nerve rather than calming other people’s.

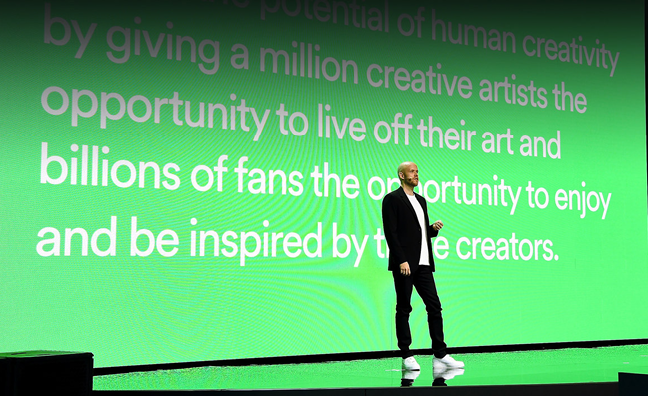

Hark back to that IPO and the language around it. Spotify CFO Barry McCarthy spelled out the “clear financial benefits” of the direct listing while Ek waxed lyrical about the company’s philosophy in a manner that was more Glastonbury Stone Circle than Wall Street bull market.

“Spotify has never been a normal kind of company,” he said. “As I mentioned on our Investor Day, our focus isn’t on the initial splash. Instead, we will be working on trying to build, plan, and imagine for the long term. Sometimes we succeed, sometimes we stumble. The constant is that we believe we are still early in our journey and we have room to learn and grow.”

Spotify has certainly stumbled of late. It will almost certainly lose its US market leadership to Apple Music sometime soon, if it hasn’t already. YouTube Music and Amazon Music are also making big inroads. It’s suffering from a talent drain, long-serving staff complain of its new, more corporate approach, while its relationship with the major labels remains more fractious than either side would want.

But, seven months into its life as a public company, it’s still the global market leader with huge potential to cash in around the world. Most people expect today’s earnings call to reveal still-strong growth. It can still make or break artist careers with a tweak of its algorithm. And if Ek gets too much flack for his share price, well, he can always point out that he foresaw this very moment when he spoke on the eve of the IPO.

“Nothing ever happens in a straight line — the past 10 years have certainly taught me that,” he said. “My job is to ensure that we keep our foot on the pedal during the ups, so that we don’t become complacent, and that we continue to stay the course with a firm grip on the wheel during the downs.”

Hold on tight, then. We’re about to find out if Spotify can still persuade other people to put their money where Daniel Ek’s mouth is...